USD/JPY Price Analysis: Bullish correction in full-flight, 135´s eyed

- USD/JPY bulls are in charge and eye a deeper correction.

- Bulls need to overcome the temporary hourly resistance.

USD/JPY is making its way north following confirmation that inflation is sticky in the US from the day´s Consumer Price Index outcome earlier in the US session. As per the prior analysis, the bulls are making a firm correction and the bias remains in the hands of the bulls as the following will illustrate.

USD/JPY prior technical analysis

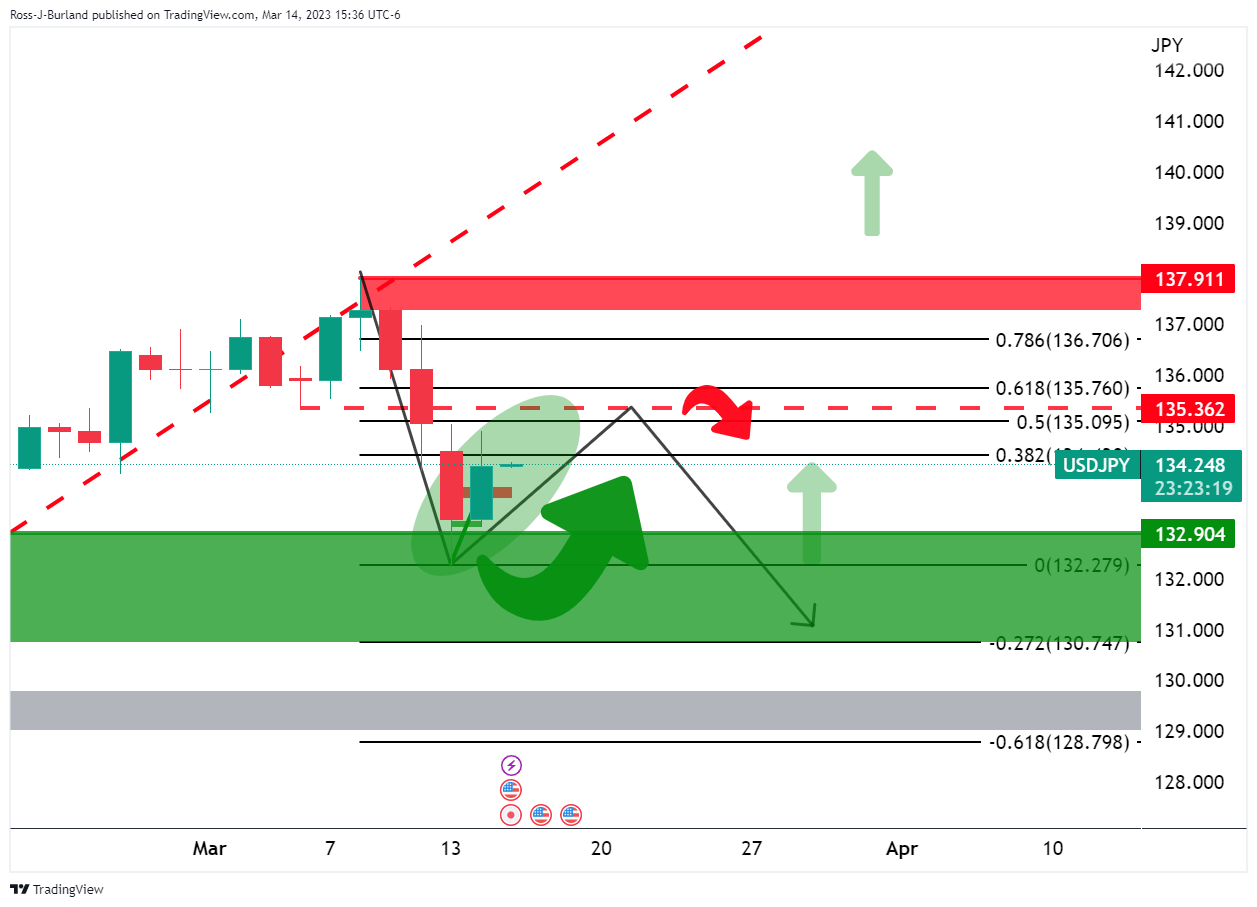

It was stated, that ´´on a daily basis, USD/JPY is moving into a support zone that could result in a correction ahead of the US CPI data with the 134.50-70 eyed as per the daily Fibonacci scale as illustrated above. However, on a lower time frame:´´

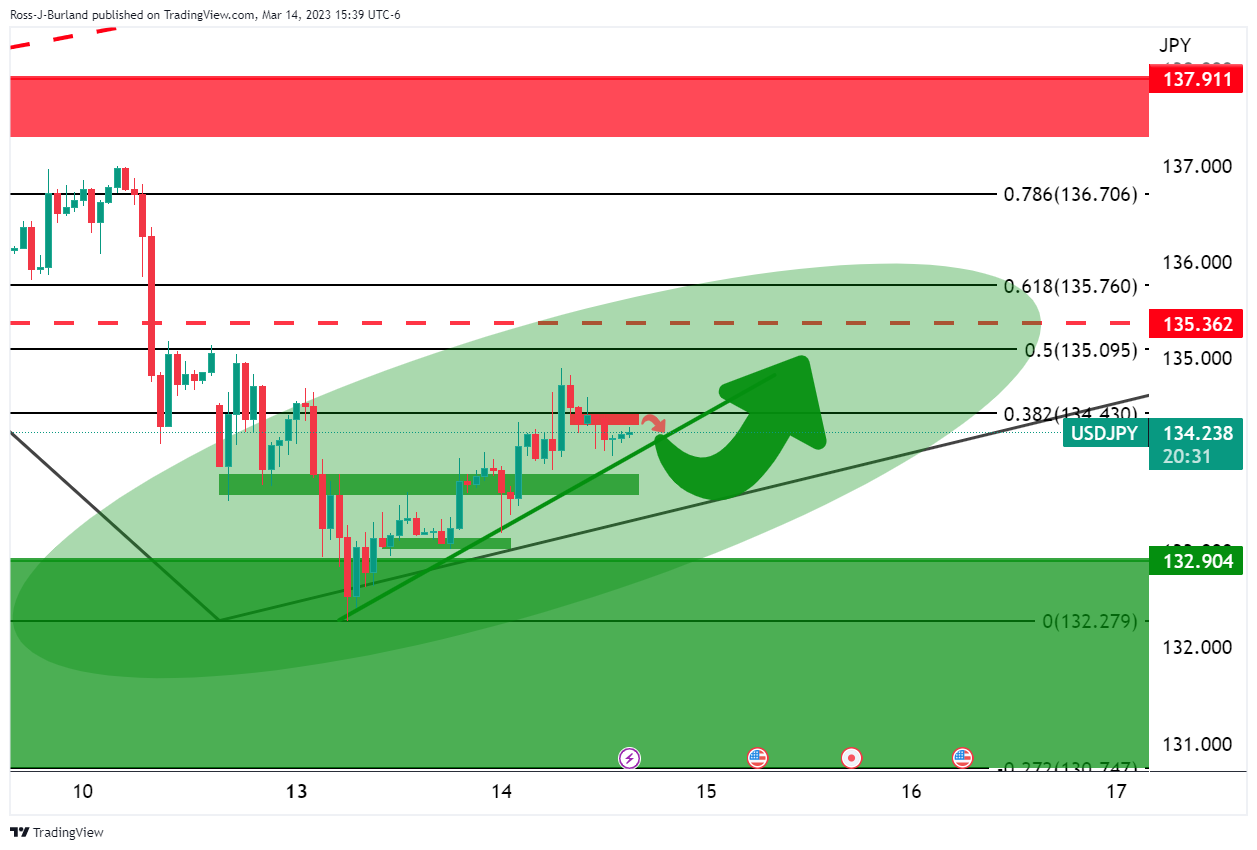

´´There is a lot of resistance between 133.70 and 134.00 that the bulls will need to volt first.´´

USD/JPY update

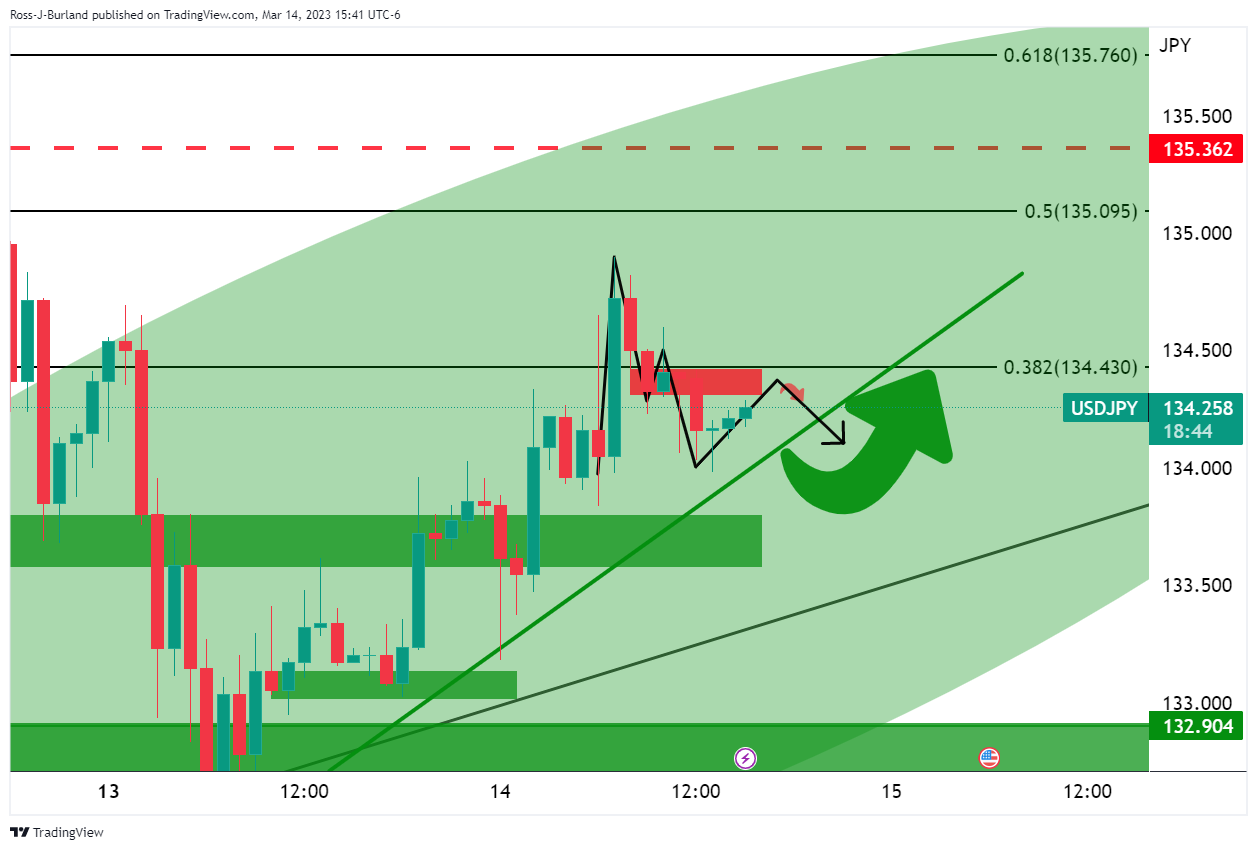

As can be seen, the bulls have indeed moved in and the price is well on its way toward the 135s. However, on the way, there are prospects of a correction and some grounding before further demand:

The bulls will need to commit to the trendline support, or thereabouts with resistance potentially found in the M'formaiton´s neckline for the meanwhile: